Research & Academics

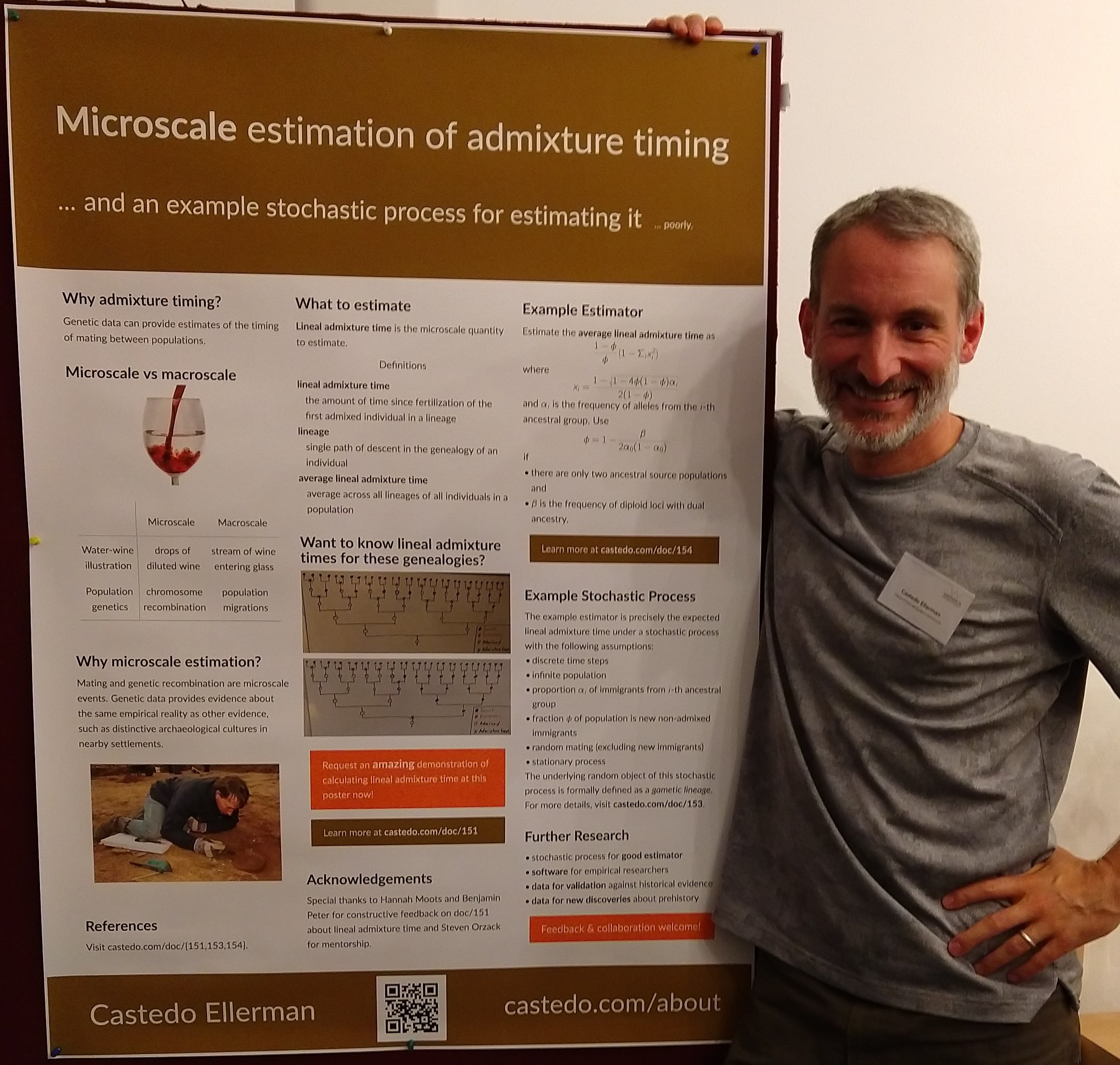

For the past few years, I have been studying math and genetics, especially population genetics, and developing publishing technology.

Posts & Publications

Visit castedo.com/doc for links to recent posts and publications.

For research software contributions, I am listed as an author on the journal article: Baumdicker, Franz et al. "Efficient ancestry and mutation simulation with msprime 1.0." Genetics, March 2022; doi:10.1093/genetics/iyab229.

In 2005, I published the peer-reviewed article "Leanest Quasi-Orderings" with Professor Nachum Dershowitz in the academic journal Information and Computation and presented the paper at the 16th International Conference on Rewriting Techniques and Applications in Japan.

Groups/People I've Worked With

- ~2022 Fresh Pond Research Institute (Steven Orzack)

- ~2021 Novembre Lab (rotation)

- ~2020 msprime / tskit devs (Jerome Kelleher, Peter Ralph, et al)

See software page for contributions during these research experiences.

Education

This list of books I've read is representative of my studies outside of formal education programs.

- Master's in Mathematics in Finance from the Courant Institute of Mathematical Sciences at New York University

- Budapest Semesters in Mathematics

- B.S. in Mathematics & Computer Science, University of Illinois Urbana-Champaign

Genetic Reporting Service

Between 2016 and 2022, I developed and ran a genetic reporting service called Gene Heritage. I implemented the infrastructure and technology behind the service to make it easy for consumers to access genetic calculations I developed in an open-source R package. More than 16,000 visitors signed up, and more than 5,000 genetic reports were purchased.

You can read more in this blog interview.

Freelance Quantitative Analyst/Developer

In 2005, with the birth of my first child, I started working part-time from home as a freelance software developer. I've coded quantitative software in a wide range of applications, such as automated trading, statistical ETF arbitrage, phonetic analysis, statistical analysis, and extracting financial data.

My favorite languages are Python, TypeScript, R, and C++. I am also experienced in CSS/HTML, Vue.js/Node.js, SQL, Linux containers, Bash, Git, LaTeX, AWS, and doing too much in Excel. Over the course of more than three decades, I've also programmed in Java, Perl, C#, Visual Basic, C++/CLI, x86 assembly, PHP, PL/SQL, and MATLAB.

Wall Street

Before freelance software development, I worked at investment banks CSFB (Credit Suisse First Boston) and Bear Stearns, in automated market making and financial analytics for traders. My projects included developing a matrix-based expression language for defining multi-asset path-dependent derivative products and a program for computing resource-intensive statistics from historical implied volatility of equity options.

Microsoft and Silicon Valley

Before my time in finance, I worked in the software industry. I was a Program Manager for Microsoft on Internet Explorer during the "browser war" of the late 1990s. Following Microsoft, I joined Silicon Valley startup Tellme Networks, which was later acquired by Microsoft.

For more details, see linkedin.com/in/castedo.

Castedo

Castedo